Many people have been asking what we expect for the Real Estate market in 2018. While it is a bit early to tell the impact of one of the major items at play in 2018, namely tax reform, 2018 looks to be favorable for the real estate markets largely due in part to a strong job market and strengthening economies globally. We have broken down our 2018 outlook into 4 key areas – tax reform, economic backdrop, inventory, and rentals

Tax Reform

The new tax law is likely to be the most impactful to the 2018 real estate market compared to our other key areas, and is a large element of uncertainty for the housing market. This sweeping overhaul with changes from personal to corporate taxes has provisions that are expected to impact real estate markets, especially in high tax states such as New York, New Jersey, and California.

The 2 changes to be most aware of in the bill are the capping of State and Local deductions to $10,000 and the reduction of the Mortgage Interest Deduction from $1MM to $750,000. Both of these changes could make owning a home more expensive than previously planned for some individuals and impact the amount being considered to mortgage a home.

We are only 10 days into the New Year, so the impact of changes are still unclear. Q4 2017 activity was strong, and historically Q4 momentum carries in to the beginning of the following year. We see 2 possible scenarios that could unfold as a result of the tax changes:

- Pace of sales slows at the beginning of 2018 as buyers might pause and speak to their accountants in an effort to try to better understand their new tax picture before making a purchase. In this scenario, we see downward pressure on pricing.

- Volume and Pace of transactions from Q4 continues into 2018 as buyers may recognize that the uncertainty that may be instilled in some regarding tax reform creates opportunity, and they seize this opportunity. Additionally, buyers are likely armed with padded investment accounts and year-end bonuses.

Regardless of scenario, the largest impact of the tax bill is likely to influence buyers in the $1M+ to $5M price range.

Economic Backdrop

Moving into 2018, there are a lot of favorable economic indicators that create a favorable backdrop for housing. It is important to remember that the real estate markets are highly correlated to both the job and stock markets. Economies around the world are expected to grow in 2018 with some foreign economies outpacing U.S. growth – could foreign buyers increase in 2018?

Here in the U.S., the Fed increased their growth outlook for 2018 in their minutes released in December. Their notes utilize language that suggests a job market that will continue to remain strong, and, perhaps, grow slightly while being accompanied by rising wages. This is a positive for the housing market. Additionally, the Fed is currently suggesting 3 rate hikes in 2018 as Yellen’s term comes to an end.

The consensus among analysts is that equity markets will continue to rise in 2018. While the magnitude of the rise may not be as large as in 2017, gains will continue to add to already large investment accounts.

Inventory

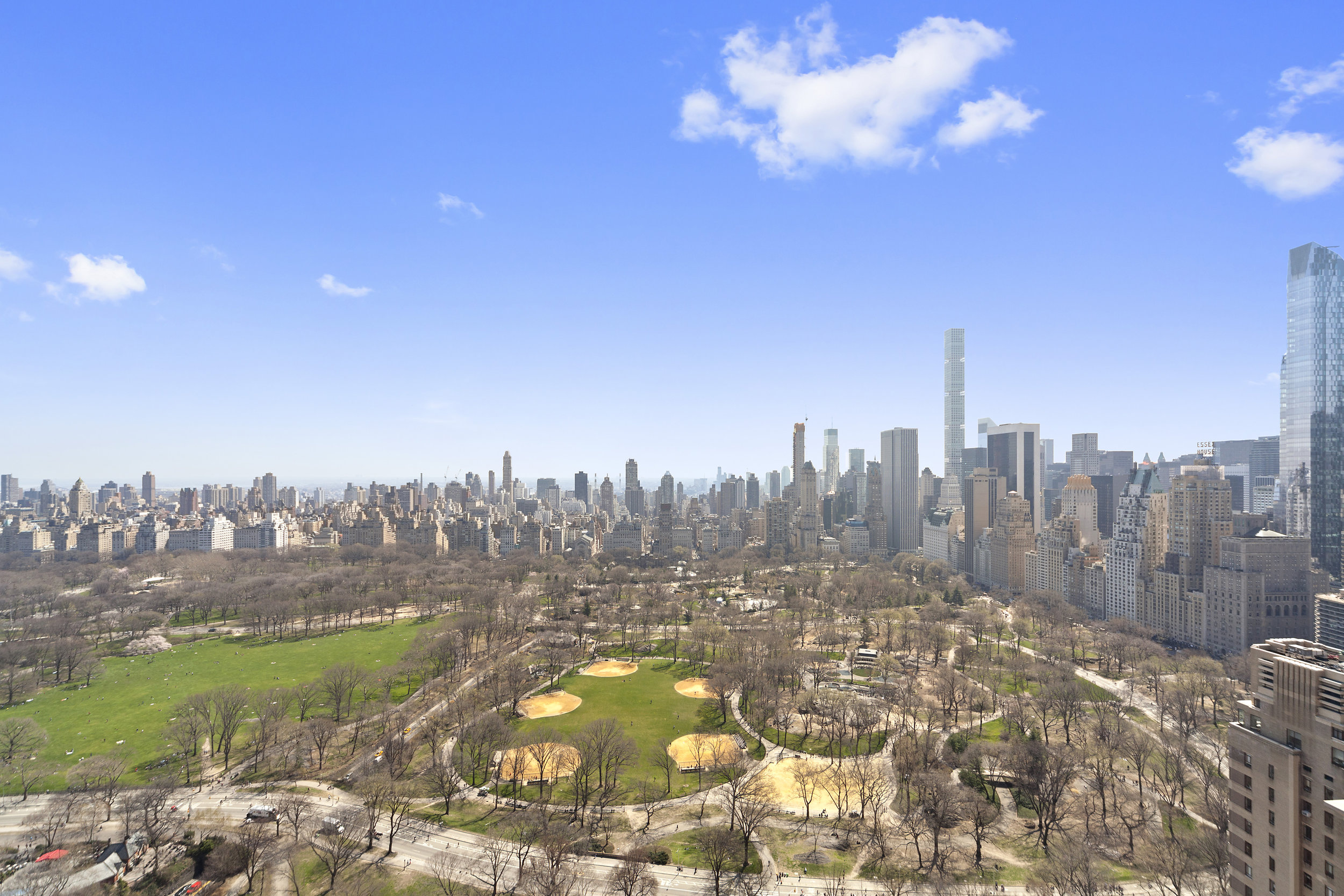

We expect high inventory in the luxury market to persist in 2018, or increase with additional new condo inventory coming to market. Developers are continuing to reshape the New York City skyline in partnership with some of the best names in architecture. Projects like 125 Greenwich and 262 Fifth Avenue will increase luxury condo inventory. Increased inventory at the higher end of the market will continue to pressure pricing at this level.

To remain competitive with the pool of wealthy buyers, we expect developments to continue to push the bar. Central Park Tower is a great example of this as they are trying to allure global titans to call the building home for their pied-a-terres or place to park money in the US market. Over-the-top amenities will continue to be the norm in both condo and rental buildings.

Rentals

The rental market peaked in 2017 after being on a march higher for quite some years. We all saw the rental market take a turn in 2017 with rents seemingly dropping across the board. We expect concessions to remain at all-time highs throughout 2018. Landlords will need concessions to lure tenants to their units. The continued pipeline of new inventory that will come on the market should cap rental prices from overly rises in 2018. However, the continued attraction of New York – labor market, culture, etc. will serve as a floor for rental prices so we do not expect any large scale drops in 2018.